Discover premium, thoroughly vetted Real Estate investments

Let us navigate the complexities, so you can elevate your portfolio effortlessly

with our exclusive 183-point due diligence process

we deliver real estate passive investment opportunities to you that 'normally' you never hear about.

Apply To Join Our 'Elite Investor' Circle

10M+

Total Transactions

$50K

Minium

Investment

15-25%+%

Yearly ROI

5-10%

Targeted Annual Distributions

BUI

L

D

I

N

G

P

A

R

T

E

N

E

R

S

H

I

P

The Vision

At Invest in Sqft, we specialize in providing successful entrepreneurs and high-net-worth individuals with exclusive access to top-tier real estate investment opportunities. Our mission is to democratize high-caliber investments, facilitated by our rigorous 183-point due diligence process, derisking each opportunity as much as possible . Our team, a blend of seasoned real estate experts and financial strategists, is dedicated to offering transparent, integrity-driven services that align with your investment goals. We don't just offer investments; we build enduring partnerships, guiding you towards informed decisions for a prosperous future in the realm of sophisticated real estate.

Learn From Our Detailed Approach to Due Diligence

Dive deep with us into the intricacies of real estate investing. At Invest in Sqft, our comprehensive 183-point due diligence process is a journey of discovery, revealing the finest details that matter. We meticulously analyze market trends, financial viability, and long-term potential, uncovering layers of insights to ensure each investment stands out for its security and promise. With our thorough evaluation, you gain not just investments, but invaluable knowledge and confidence in your decisions.

DUE

DI

LLIGENCE

AS MENTIONED ON:

What We Offer

Explore our diverse portfolio of handpicked real estate investments, each meticulously vetted to ensure unparalleled quality and strategic value across multiple asset classes

Multi Family

Discover exceptional multifamily opportunities with us, where our expertise uncovers the best-kept secrets in prime locations.

Self Storage

Unlock prime self-storage investments, meticulously sourced to offer you unparalleled opportunities in a high-demand market.

Mobile Home Parks

Explore our curated selection of mobile home park investments, where we unveil hidden gems in this uniquely profitable sector.

Raw Land

Delve into the potential of raw land investments, handpicked by our experts for their exceptional growth and development prospects.

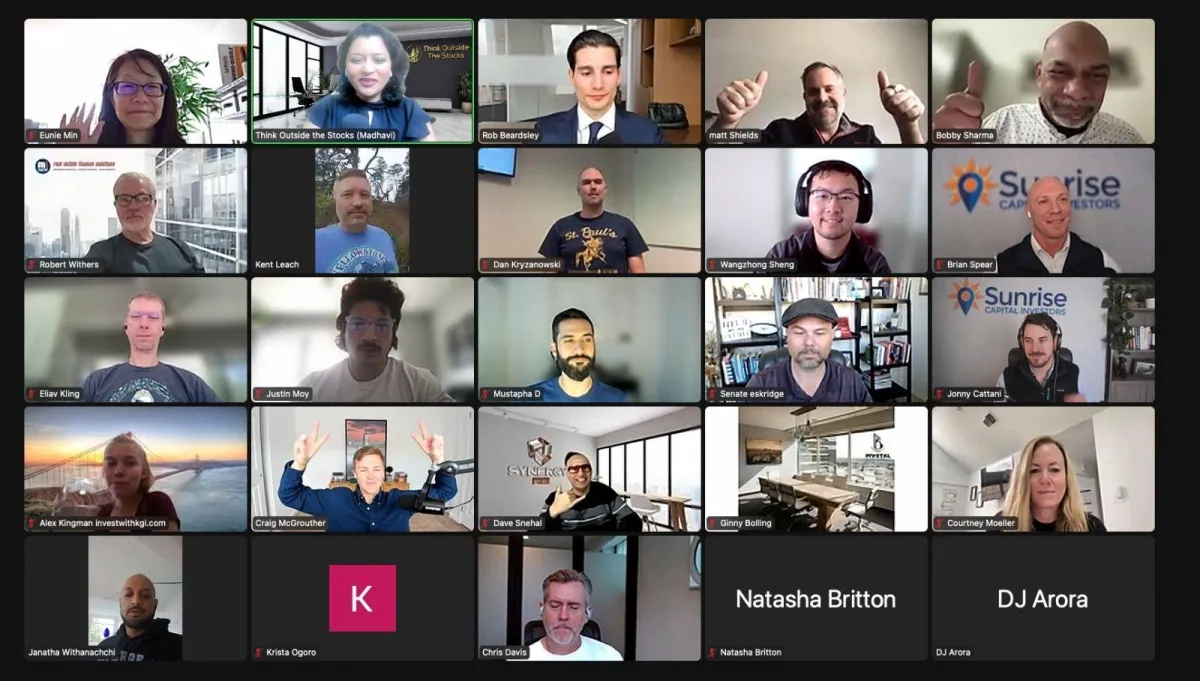

Group Coaching

Join us every Tuesday at 11 am Eastern for our friendly and informative Deal Day! It's a great chance to get an inside look at the exciting opportunities we're currently exploring or those under our detailed due diligence process. Come, dive deep with us and be part of the journey

WE CAN HELP YOU!

At Invest in Sqft, we empower busy entrepreneurs and high net worth individuals with streamlined access to exceptional real estate investments. Our expertise lies in identifying and vetting lucrative opportunities that align with your financial aspirations. With us, you gain more than investments; you gain a dedicated partner committed to navigating the complexities of the real estate market for you, maximizing your returns while minimizing your involvement

NEED HELP?

Join Our Elite Circle Investment Club

Join our exclusive Invest in Sqft Club, designed specifically for the ambitious, busy entrepreneur and discerning high net worth individual. Here, you'll find streamlined, top-tier investment opportunities that respect your time and match your drive for success. Our club offers a gateway to premium real estate ventures, meticulously curated to meet your high standards and busy lifestyle, ensuring you never miss out on a lucrative opportunity.

What makes Invest in Sqft's investment opportunities unique?

Answer: Our investment opportunities stand out due to our rigorous 183-point due diligence process. This ensures that each investment is thoroughly vetted for financial viability, market trends, and long-term potential. Our approach focuses on delivering high-quality, secure, and strategically sound real estate investments, specifically tailored for busy entrepreneurs and high-net-worth individuals

Who is eligible to join the Invest in Sqft Club, and how can I apply?

Answer: Our club is tailored for successful entrepreneurs and high-net-worth individuals who are accredited investors looking for premium real estate investment opportunities. If you fit this profile and are interested in joining, you can apply through our website. Our team will review your application to ensure alignment with our investment criteria and club values.

How does Invest in Sqft ensure the confidentiality and security of its members' investments?

Answer: At Invest in Sqft, we prioritize confidentiality and security in all our operations. We employ stringent data protection protocols and ensure all member information and investment details are handled with the utmost discretion. Our commitment to privacy is as strong as our commitment to delivering exceptional investment opportunities.

Follow us

Investing Involves Risk, Including Loss Of Principal. Past Performance Does Not Guarantee Or Indicate Future Results. Any Historical Returns, Expected Returns, Or Probability Projections May Not Reflect Actual Future Performance. While The Data We Use From Third Parties Is Believed To Be Reliable, We Cannot Ensure The Accuracy Or Completeness Of Data Provided By Investors Or Other Third Parties. Neither Invest In Sqft, LLC Nor Any Of Its Affiliates Provide Tax Advice And Do Not Represent In Any Manner That The Outcomes Described Herein Will Result In Any Particular Tax Consequence. Prospective Investors Should Consult With A Tax Or Legal Adviser Before Making Any Investment Decision.

© Copyright 2024. Invest In Sqft. All rights reserved.